Pharmaceutical Packaging

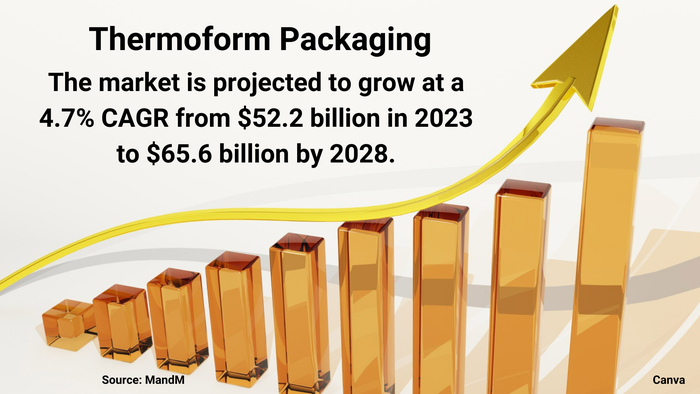

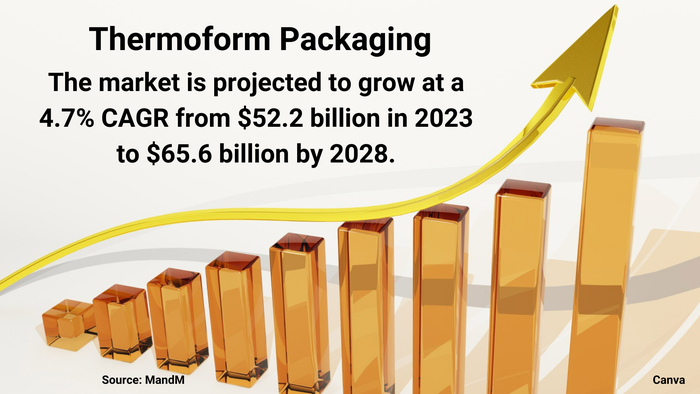

Thermoform packaging market graphic

Packaging Design

Market Dynamics Favor Thermoform PackagingMarket Dynamics Favor Thermoform Packaging

Healthy demand from food and pharmaceutical companies will spur growth, despite sustainability challenges.

Sign up for the Packaging Digest News & Insights newsletter.